| |

Fuzzy Math: AARP’s Bogus "Solvency Calculator"

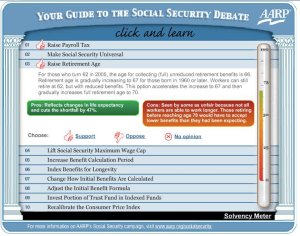

AARP has created a flash game to explore various policy alternatives it claims would make the Social Security system solvent, but the game is completely misleading... |  |

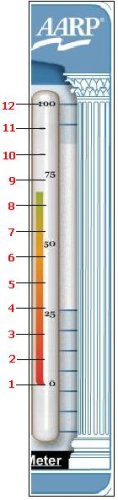

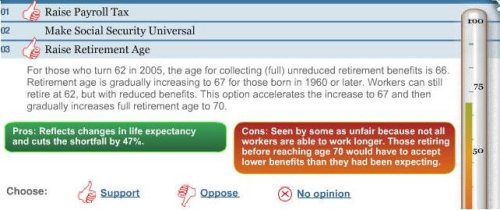

| The first problem with this calculator is the meter. An extra mark has been added between 0 and 100, making each mark worth 9 degrees instead of 10. The visual effect the extra mark is to add about five degrees through an optical illusion. For example, in the image to the left a viewer who is used to evaluating a thermometer in increments of 10 would assume the solvency achieved to be about 70-73. However, because of the 9-point increments, the actual value is much closer to 67. AARP's "Solvency Calculator" gives players the visual impression of having moved anywhere from 3 to 5 degrees closer to solvency than is actually the case. |

The second problem is that the calculator incorrectly presents the effects of combinations of individual policy changes.

For example, the calculator claims the individual effect of raising payroll taxes will improve solvency by 22 points and raising the cap of taxable wages would improve solvency by 45 points. It further claims the combined effect of both changes would increase solvency by 67 points. It is wrong to simply add up individual effects to estimate a combined effect.

When more than one feature of policy is changed those individual changes will interact with each other and often diminish each other’s effects. Increasing payroll taxes, for example, makes it more likely that employers will have to cut wages or even jobs. This causes salaries to shrink and, consequently, many salaries will not be high enough to be affected by an increase in the cap on taxable income. The AARP's "Solvency Calculator" miscalculates the true combined effect of policy changes on the overall solvency of the system.

A final flaw in this calculator is that AARP is making a host of fiscal and demographic assumptions, but it does not tell game players what those assumptions are.

For example, by making claims about the solvency effect of raising the retirement age, AARP is making assumptions about the average life expectancy of individuals. Without knowing what those assumptions are, there is little reason to trust the benchmarks AARP uses to evaluate "solvency" in the game and even less of a reason to take any of the figures presented seriously.

AARP is trying to sell you the assertion that their "Solvency Calculator" is a fair look at all of the reform proposals out there. We at S4 aren't buying, and we hope that you aren't either.

|

|

|

|

|

|