February 10th, 2009Where does the buck stop?

February 10th 03:48:02 PM

How can it be that after a Presidential address about the $800 billion or more Obama plans to spend on an economic stimulus, someone in the media asks for a reaction to Alex Rodriguez's admission of steroid use? (Way to ask the tough questions!) How can it be that after all of the problems with TARP -- which included lots of pork and gave money to the Bank of America, which spent $10 million on a Super Bowl party in Florida -- we're setting ourselves up to waste even more money? And how can it be that there is so little scrutiny of government spending roughly the size of Australia's GDP, while Australia itself worries about passing a much smaller stimulus for fear that its future generations will be weighed down with debt? Oh, and in case you're wondering: the Congressional Budget Office ran the numbers and "President Obama's economic recovery package will actually hurt the economy more in the long run than if he were to do nothing."

Posted by Ryan Lynch| Comments (0)

January 23rd, 2009Americans Want Social Security Secured

January 23rd 07:17:51 PM

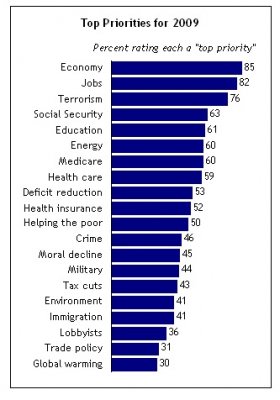

According to the Pew Research Center, 63% of Americans believe that Securing Social Security should be a top priority for 2009. Of the twenty issues asked, Social Security ranked high at number four, after the Economy, Job and Terrorism. All Americans are recognizing the urgent need for Social Security reform and the hurtful impact that waiting has on future generations.

Posted by Jo Jensen| Comments (0)

January 21st, 2009A new age?

January 21st 01:28:10 AM

Congratulations to President Obama. One can only hope that the new administration is up to the many challenges that lie ahead, particularly with respect to the economy. As Obama said today in his inaugural speech, "Our economy is badly weakened, a consequence of greed and irresponsibility on the part of some, but also our collective failure to make hard choices and prepare the nation for a new age."

Entitlement reform is no doubt one such hard choice, and we have been encouraged thus far by the president's comments about Social Security. Obama is putting together a fiscal responsibility summit next month and, according to the LA Times, will address entitlements directly after health care. Still, it is hard to know how seriously to take Obama's intention to reform Social Security. First, entitlement reform isn't easy. So while a fiscal responsibility summit may be a good idea, what will be its objective? Gray-haired experts on entitlements would be happy to gather in a room and discuss reform for a couple days (especially if there are TV cameras), but what good would that do our generation? Second, there is a desire on the part of some to wait and see how much change the new president offers. Though Obama spoke during his campaign about providing substantive change that would prove cynics wrong, some of us are probably reluctant to believe in a new way of politics just yet for fear we will be disappointed. A new age? Let's hope so.

Posted by Ryan Lynch| Comments (4)

January 08th, 2009Will the youth benefit from Obama's Social Security reform?

January 08th 12:36:19 PM

President-elect Obama's children meet the S4 Ostrich, which travels around the country urging politicians to get their heads out of the sand and reform Social Security. Washington, DC — Students for Saving Social Security, the nation's largest youth organization dedicated to reforming Social Security, today challenged the incoming Obama administration to make good on Wednesday's promise to reform Social Security. "The key is going to be restructuring retirement savings in a way that benefits future retirees," said Jo Jensen, the executive director of Students for Saving Social Security, or S4. "It remains to be seen how serious Obama is about entitlement reform, as well as how a proposal from him would gain the support of young people, who voted more than two-to-one in his favor." Jensen continued: "Students will be watching closely in the weeks ahead. We look forward to hearing more about how Obama will reform Social Security and retirement policy in a way that benefits future retirees."

Posted by Jo Jensen| Comments (2)

January 07th, 2009Obama to address entitlements in first term?

January 07th 07:32:38 PM

Encouraging news from the New York Times: Changes in Social Security and Medicare will be central to efforts to bring federal spending in line, President-elect Barack Obama said on Wednesday, as the Congressional Budget Office projected a $1.2 trillion budget deficit for the fiscal year. “We expect that discussion around entitlements will be a part, a central part” of efforts to curb federal spending, Mr. Obama said at a news conference. By February, he said, “we will have more to say about how we’re going to approach entitlement spending.”

Curbing spending is much better than increasing payroll taxes, as I'm sure at least the nearly 60% of young people who want to opt out of Social Security would agree.

Posted by Ryan Lynch| Comments (0)

December 19th, 2008'An honest assessment'

December 19th 05:47:17 PM

"Medicare, Medicaid, and Social Security accounted for 16 percent of total government expenditures 40 years ago. Today, they comprise 40 percent of all expenditures." So says the report from Treasury and OMB which came out earlier this week. The report also includes this commentary from Treasury Secretary Paulson: "Throughout this unprecedented year, the Treasury Department has worked to achieve and maintain the stability of the financial system with short-term actions, but we must not forget the long-term needs that pose a significant threat to our country's fiscal sustainability." We agree, which is why we recently submitted this letter to the Wall Street Journal: The eviscerating retirement costs of American automakers ("America's Other Auto Industry", editorial, Dec. 1) should serve as a warning about the need to deal with our nation's entitlement programs, especially given that Detroit's three-to-one ratio of workers to retirees is the same dependency ratio that Medicare and Social Security now face. Social Security alone has $13.6 trillion of unfunded liabilities — that's nearly 400 times Detroit's bailout request. Perhaps we can afford to extend Detroit a lifeline, but who will bail out America when our retirement promises become unaffordable?

President-Elect Obama is well aware of the problems our entitlement programs face. In fact, here is what he said last year on The Tonight Show with Jay Leno: People -- the American people on Social Security or healthcare, they know these are tough problems and what they want is, I think, an honest assessment of what it's going to take to solve the problem and not a lot of petty-back fighting and grandstanding. And hopefully that will be an effective strategy in the campaign.

Given that Obama's attention to Social Security was an effective strategy, will he work in his first term to address the unsustainable costs that lie ahead? Or will he show that he cares more about getting votes than following through on the change that he promised?

Posted by Ryan Lynch| Comments (0)

December 18th, 2008Why personal accounts still make sense

December 18th 06:10:33 PM

It's a sad fact of life that humans aren't always very good at making decisions. What is interesting, though, is that different types of mistakes come up repeatedly, suggesting that some decision-making errors are systematic. For example, many of us have a bias toward seeking only the information that confirms -- rather than refutes -- what we already believe. Here's another example. It's a question you may know from The Tipping Point: If you take a large piece of paper and fold it in half, then fold it in half again, and again and again until you have folded the original piece of paper in half 50 times, how tall will the stack be? As tall as you? As tall as the building you're in? The answer is, the stack would reach roughly to the sun. If you folded the paper in half again, the stack would reach to the sun and back. This is a useful example to bring up not just because it bears some resemblance to the effects of compound interest, but also because it shows how decision-making errors may lead us to ideas that differ greatly from reality. More directly, it may seem reasonable to conclude that personal accounts are too risky given the state of the financial markets. Two recent think tank papers show in different ways why that conclusion is incorrect. First is a paper by Gary Burtless at Brookings. To be clear, Burtless argues against personal accounts. Yet the substance of his analysis could just as easily lead to the opposite conclusion. Keeping in mind that Social Security currently replaces on average less than 40% of earnings, Burtless finds the following for a personal account of 4%: "The average replacement rate is 40%. For workers retiring after 1945 the replacement rate has averaged 49%." In other words, a 4% personal account alone would have replaced on average nearly half of income for those retiring in the last 62 years. Meanwhile, the 12.4% tax that we've been paying into Social Security replaces only about 40% of income. How is this an argument against personal accounts? It isn't, of course. As it turns out, Burtless objects to the volatility of personal account returns rather than the size of those returns, which is a bit like saying that a slightly uneven raise for all workers is worse than no raise. Another problem with the Burtless paper is that he ignores some of the ways in which we might reduce the volatility of returns, such as gradually shifting money away from equities during the course of a worker's contributions. Thankfully, Andrew Biggs at AEI does use such risk-reducing tools in his historical modeling of personal account returns. The conclusion? Biggs finds that people retiring today would do more than 15% better under a system of 4% personal accounts. In his own words: Opponents of personal retirement accounts as part of a reformed Social Security program have pointed to recent market downturns as self-evident proof that accounts would be a poor policy choice. There are many valid arguments for and against personal accounts, but the simulations herein show that current market conditions do not prove the critics right.

More pointedly, the critics are wrong. Even when markets are a mess, personal accounts make sense.

Posted by Ryan Lynch| Comments (0)

December 08th, 2008No small change

December 08th 09:38:02 PM

"If the federal government stopped the Medicare and Social Security programs tomorrow -- collecting no more payroll taxes and allowing no more accrual of benefits -- it would still owe up to $52 trillion to those who have already earned these benefits." How much is $52 trillion? "To put the numbers in perspective, the size of the entire U.S. economy is $14 trillion."

Posted by Ryan Lynch| Comments (0)

December 05th, 2008Who does AARP represent?

December 05th 12:05:56 AM

We already knew AARP doesn't care about young people. Now this from one AARP member: "They're making money on the backs of the old people." The article explains how AARP has profited from Medicare Part D -- which the organization supported even though many of its members did not -- but leaves unanswered why AARP opposes personal accounts. Would greater personal wealth and increased financial literacy reduce demand for AARP mutual funds?

Posted by Ryan Lynch| Comments (0)

November 10th, 2008S4 on the Northwestern Radio

November 10th 03:54:09 PM

S4's Ryan Lynch was on the Northwestern University radio show "Feedback," which is co-hosted by National Coordinator James D'Angelo. Click here to listen to Ryan.

Posted by Jo Jensen| Comments (0)

[Next 10 >>]

|