|

|

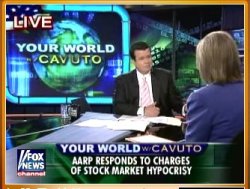

Neil Cavuto slams AARP for hypocrisy

May 01st 07:02:38 AM

| After being one of the most outspoken opponents of Social Security reform, AARP is winding up to offer several mutual funds to its members according to this Washington Post story. |

|

The three funds _ conservative, moderate and aggressive _ are designed to simplify investment choices for seniors, AARP Financial said in a news release issued Monday. Each fund, carrying the AARP brand, invests in a diversified mix of stocks, bonds and other securities, with the allocation based on the level of risk, it said.

The funds are part of a new move by the powerful seniors lobby to compete for the dollars of baby boomers _ a huge and affluent cohort. AARP has been moving beyond selling discounted products and services, such as travel, insurance and computers, to its members and has developed its own financial products, consulting service and "seal of approval" program.

Does it seem hypocritical that a company that just last year was calling the stock market a "risky parlor game" is now singing the praises of their new mutual funds?

S4 thinks so, and so does Neil Cavuto. He claims that AARP is trying to have its cake and eat it too, exemplified by its efforts to corner the investment market for seniors by opposing the plan to allow Americans to invest a portion of their Social Security contributions in mutual funds.

Let's face it, folks. By expanding from a seniors organization that works on behalf of seniors to a business that exists to extract money from seniors, AARP has outgrown its mandate.

Watch the video of the segment by clicking here.

Posted by Jeremy Tunnell

Comments

In addition to being hypocritical, AARP mutual funds completely rip off seniors. Toward the end of this interview Smith states: "[AARP gets] $5 for every $10,000 that's invested in these funds."

$5 may not sound like much, but in the investment world, it is huge. Barclays, which manages the retirement program for federal employees, the Thrift Savings Plan, only requires 16 cents in management fees per $10,000 that's invested. (See factcheck.org: http://www.factcheck.org/article310.html )

This means AARP is ripping seniors off to the tune of $4.84 per $10K of investments.

What's more, the Thrift Savings Plan was the model used by many politicians who were pushing for personal accounts in 2005--it is easy, efficient, and a good deal for all workers.

Cavuto does not seem to be just advancing a conspiracy theory when he said "So, methinks that you knew you were planning this with the funds. You didn't want competition from Uncle Sam. You want your cake and eat it, too." If you compare the deal AARP is offering seniors to the deal PRAs could have offered all Americans, he is right on.

Posted by Nicola Moore on May 01st 11:02:57 AM

|

|

|

|

|